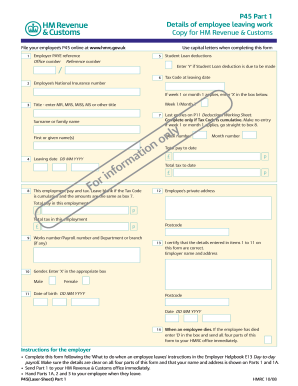

Who needs a P45 form?

This form is used in the United Kingdom and the Republic of Ireland when the employee leaves work. The form is completed by the employer.

What is the purpose of the P45 form?

This form is very important for the employee, as it has details of earnings and taxes paid. The details of the information regarding the employee leaving work is forwarded to HM Revenue and Customs, where tax details on the employee’s taxpayer record are recorded.

What documents must accompany the P45 form?

This can be accompanied by other forms depending on the employee’s needs. As a rule, the P45 is accompanied by the P11 form, Deductions Working Sheet.

When is the P45 form due?

The form is completed before the employee leaves the job. The worker tells about his decision to leave work beforehand and asks to prepare the form. The estimated time for completing the form is 20 minutes.

What information should be provided in the P45 form?

The P45 form has several copies, each for a certain addressee: one copy for HM Revenue and Customs; one copy for the employee; one copy for the employer; one copy for the new employer. Part 3 of the form is completed by the new employer. When completing the form, the employer should follow the instructions in the Employer Help book E13 Day-to-day payroll.

The employer has to provide the following information:

-

PAY reference (office and reference number)

-

Student loan deductions

-

Employee’s national insurance number

-

Tax code at leaving date

-

Title, name, gender, date of birth, address of the employee

-

Leaving date

-

Total amount of earnings to the date of leaving

-

Total tax amount to the date of leaving

-

Work number/payroll number

The employer should also sign and date the form.

What do I do with the form after its completion?

Part I of the form is sent to the HM Revenue and Customs office. Part 1A, 2 and 3 are given to the employee.